At our content writing agency, we emphasize the importance of having niche experts on the team. And every time we have a new writer joining us (or one of our existing writers wants to explore new areas), our expert arranges an introductory course. As part of this “technical writing initiation process”, we provide educational resources, guidelines, and video lessons on everything they need to know.

Let’s say a new author joins Contenteam and is eager to write about Forex. They have the technical knowledge, but they may be unsure about how to express this knowledge in an article. How do they know the do’s and don’t’s for trading and financial content? How can they instantly access insights that are otherwise developed over time?

In this guide, we wanted to give you a glimpse into our framework. You’ll see an example of how we teach writers to create articles about a specific trading term.

What Is Stop Loss and Why Do You Need It?

Let’s focus on the main heading right off the bat. It should be concise and descriptive, and the article can often benefit from having a question in the title (a popular tactic for engagement).

Then we move on to the introduction. This is where we need to put ourselves into the reader’s shoes. If you’re writing an article with informational intent, something short and simple will do:

One of the most important trading terms for Forex beginners to learn is stop loss. In this article, we will give you a thorough description and describe a few common ways to use it. You will also learn how to install stop loss and change settings for maximum efficiency.

Table of Contents

Without forcing readers to wait any longer, give them the definition that they came for:

Stop loss is a pending order that closes an open position. Unless the order is canceled, it will be triggered once the losses for a given transaction go over the specified limit. The goal of stop loss is to protect traders against massive losses, which is especially helpful when a trader leaves their workspace and can’t monitor the position.

Once the reader understands the general concept, consider amplifying it with a simple example. A numbered list is a great format when you’re describing a process.

Here is how it works:

1. A trader opens a buy position for EUR/USD at a price of 1.2000.

2. They set a stop loss at 1.1990 in case the pair moves in the opposite direction than expected, i.e., when the price goes down.

3. If the price increases, stop loss won’t be triggered, and the position will be closed with a profit.

4. If EUR/USD moves lower than 1.1990, the position will be closed automatically. The maximum possible loss will be 10 pips.

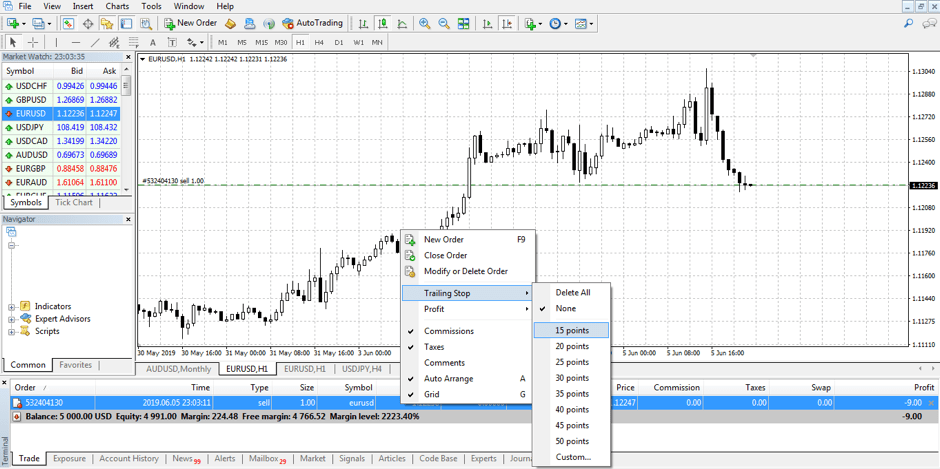

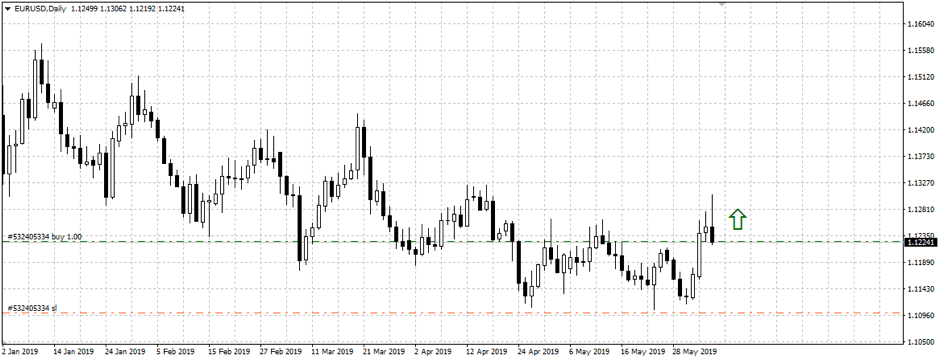

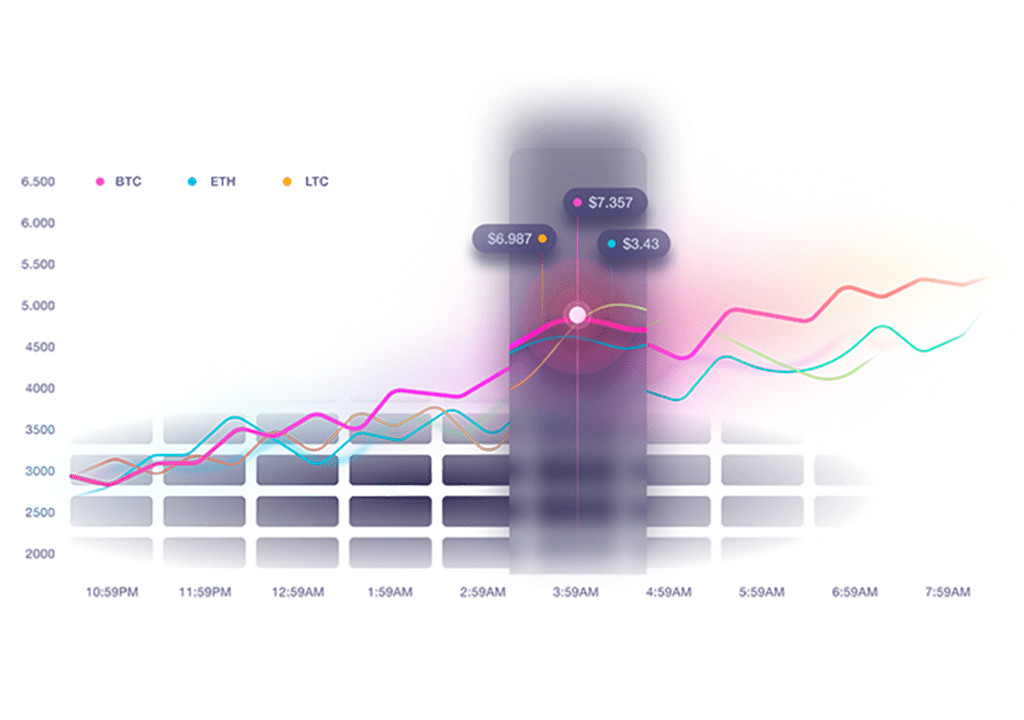

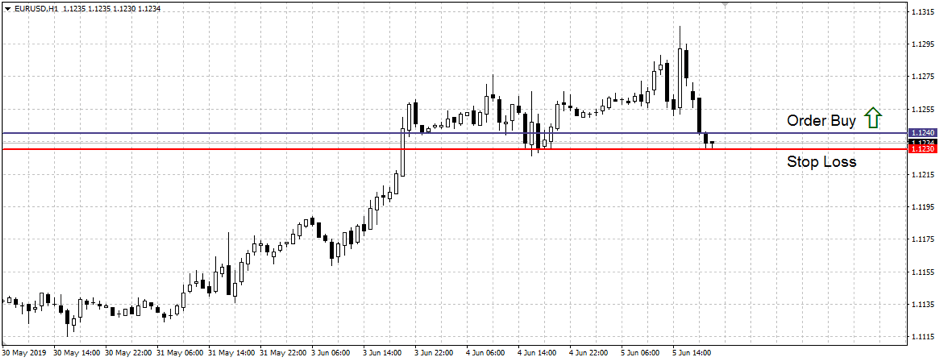

Include images and media that support or add to the information you just laid out. In this case, a graph showing the stop loss level is a great addition.

How to Set a Stop Loss in the MT4 Trading Platform

People are always searching for tips and how-to’s. If the reader doesn’t know what stop loss is, they are unlikely to know how to set it in the trading terminal. So, in the same vein of providing as much valuable information as possible without overwhelming the reader, explain how this new tool should be used.

Important: when giving instructions for a certain interface, use the exact terms that are used in the program. Don’t use synonyms: deal ≠ trade.

MT4 trading platform allows you to set a stop loss in a matter of seconds. Choose either:

1. The classic method, which has been used since the platform’s first launch,

2. Or the quick method, which was added in 2013 with an update.

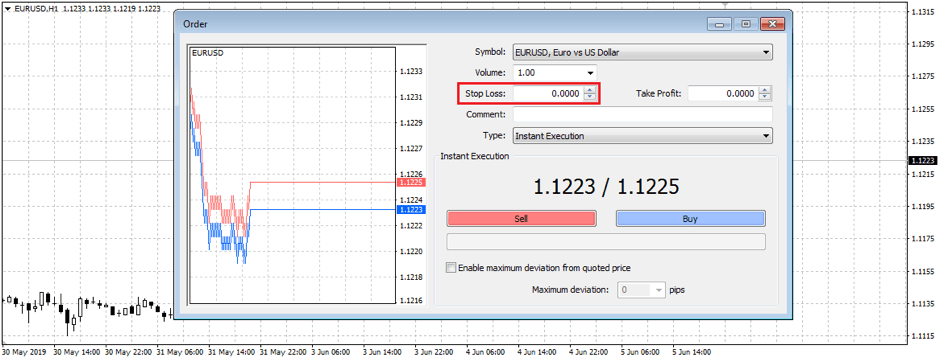

Here is a step-by-step for the classic method:

- Right-click on the chart window of your chosen asset and select “Trading” – “New Order”.

- Set the parameters (volume, type of order, opening price, and stop loss).

- As long as you keep the position open, stop loss will automatically close the position at the specified level.

The classic method also works for open transactions. Right-click on the line and select “Modify or Delete Order”. You will see the same window, where you can set up a stop loss or make changes if you already have one.

The quick method requires you to:

- Open a trade or place a pending order.

- Click the order line on the chart and drag it down (for buy trades) or up (for sell trades).

The downside of this method is that it lacks accuracy – you might not be able to drag the line to the exact point you need. But it’s great if you need to save a few seconds, e.g., in scalp trading.

Types of Stop Losses

At this point, the reader is ready to dig deeper and discover more nuances. But as you introduce any new concept, be sure to explain in the terms that readers already know. At the same time, don’t try to define previous concepts if you covered them.

In other words, when you explain a “self-modifying stop loss”, you shouldn’t include the definition of a stop loss again.

Modern trading terminals support two types of stop losses: standard and self-modifying.

Standard Stop Loss

Standard stop loss remains the same unless you manually change the level. Standard stop loss is further divided into:

- Base stop loss – the most popular type. This type implies that the position will be closed at the real price as soon as the stop loss level is touched. If the market is highly volatile, the price may move past the stop loss level, causing the trader to lose an extra few pips (this is slippage).

- Guaranteed stop loss always closes the transaction at the specified price even if the market goes past the specified level. On paper, this option is more profitable for a trader. But, the broker bears the risk of volatility on their own and can increase the spreads or commissions.

Self-Modifying Stop Loss

A self-modifying stop loss, or trailing stop, follows the price. If the asset moves in the same direction as the trader expected, the stop will move with the price at a specified distance. If it doesn’t perform as expected, it acts like a normal stop loss.

To set a trailing stop, right-click on the order line and select “Trailing stop”.

Stop Loss Strategies

Trading strategies are a tricky topic. In our experience, any SEO content writing agency needs to communicate to writers that they are not financial advisors. Even if they have the credentials, advice should be given based on a person’s individual situation. Tips and instructions don’t appeal to action in the same way.

The first challenge is making instructions straightforward and useful.

- On the one hand, they should be descriptive enough so that traders can follow them step by step.

- On the other hand, they should be stripped back of all unnecessary details. Let’s go back to the vital financial content marketing tip – don’t overwhelm the reader.

Also, avoid excessive use of trading lingo unless the article specifically focuses on it.

Be cautious about giving any sort of advice. It’s important to be unbiased when describing trading strategy, even if you have the best sources. Keep in mind that the goal of the article is to present information for beginners clearly without telling them how they should trade – instead, tell them how to trade if they decide to choose a given method.

You don’t need to include the usual disclaimer or warn about investing risks (unless there is a specific requirement).

We’ll briefly cover three basic ways to work with a stop loss.

Stop Loss Schedule

Scheduling is very common and doesn’t have any specific rules – you just set the price where you want to exit the trade. Pay attention to the following:

- Support/resistance levels

- Local minimum and maximum

- Candle highs and lows

Stop loss should be set below the support level or local minimum for buy trades and above the resistance level or local maximum for sell trades.

Stop Loss by Percent

This is called interest stop loss. It’s usually set depending on a certain value, like your available trading capital. The rule of thumb is that your losses on one trade should be under 2% of your overall capital.

Here is how you can calculate the percentage:

- Let’s say you have $100,000 in total.

- Losses for a single trade should be under $2,000 (the 2% rule).

- For a trade of 10 lots in EUR/USD, 1 pip will be to $100.

- $2,000 is 20 pips, which is where you set the stop loss.

Stop Loss by Time

This strategy implies existing the transaction at a certain time, regardless of the performance. It’s actually the trader that closes the position, not the terminal, but some experts still categorize it as stop loss.

For example, in intraday trading, stop loss by time is set at the end of the day. It doesn’t matter where the asset is moving, and by how much, the trade won’t be left open overnight.

Conclusion

A conclusion leaves your reader with a final impression.

Some writers make the mistake of copying the points from their introduction, but that’s essentially self-plagiarism. Readers already know what you have told them in the introduction, so there is no need to repeat it.

That said, don’t add new information. Give a summary of the main points, re-emphasize the possible solutions you’ve just offered, and remind that trading requires you to adapt to changing conditions. Nothing is set in stone, and everything they learn in the article can be adjusted.

Different types of stop losses are suitable for different tactics. However, it doesn’t matter what strategy a trader uses – if they are in a trade without a stop, they probably haven’t done their homework. Stop losses protect your capital and help you keep your losses within reasonable, controlled amounts. Try to implement stop loss in whatever trading system you use depending on your individual risk tolerance.

If you’re looking for someone to write about complex subjects in a simple and engaging way, reach out and let’s talk about your project! Our content writing agency will help you connect with your audience in the USA and anywhere else in the world.